What Are Some Ways In Which The Fed Attempts To Control The Money Supply

Understanding Money and Financial Institutions

131 The Federal Reserve System

- How does the Federal Reserve manage the money supply?

Earlier the twentieth century, at that place was very petty regime regulation of the U.Due south. financial or budgetary systems. In 1907, however, several large banks failed, creating a public panic that led worried depositors to withdraw their coin from other banks. Soon many other banks had failed, and the U.Due south. cyberbanking organisation was near collapse. The panic of 1907 was and so severe that Congress created the Federal Reserve System in 1913 to provide the nation with a more than stable budgetary and cyberbanking organisation.

The Federal Reserve Arrangement (ordinarily called the Fed) is the central bank of the United States. The Fed'south primary mission is to oversee the nation'due south monetary and credit system and to back up the ongoing performance of America'south private-cyberbanking organization. The Fed's deportment impact the interest rates banks charge businesses and consumers, assistance keep inflation under command, and ultimately stabilize the U.S. financial organization. The Fed operates equally an independent government entity. It derives its authority from Congress but its decisions exercise non take to be approved by the president, Congress, or whatever other government branch. However, Congress does periodically review the Fed's activities, and the Fed must work within the economic framework established by the authorities.

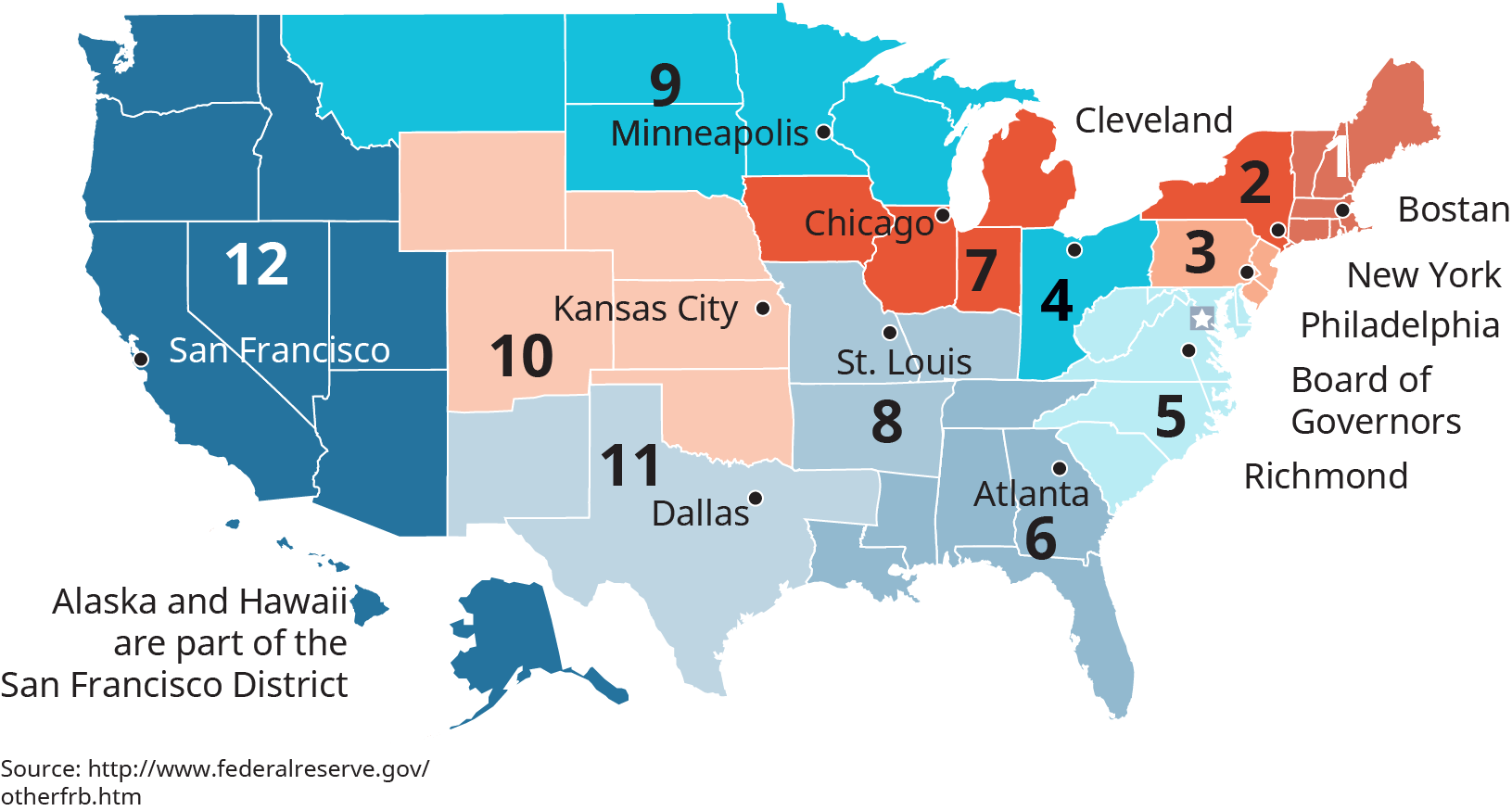

The Fed consists of 12 district banks, each roofing a specific geographic expanse. (Figure) shows the 12 districts of the Federal Reserve. Each district has its own bank president who oversees operations within that district.

Originally, the Federal Reserve System was created to control the money supply, act as a borrowing source for banks, hold the deposits of member banks, and supervise banking practices. Its activities have since broadened, making information technology the well-nigh powerful financial establishment in the United States. Today, four of the Federal Reserve System'south most important responsibilities are carrying out monetary policy, setting rules on credit, distributing currency, and making bank check clearing easier.

Federal Reserve Districts and Banks

Source: "Federal Reserve Banks," https://www.richmondfed.org, accessed September seven, 2017.

Carrying Out Monetary Policy

The virtually important role of the Federal Reserve System is carrying out monetary policy. The Federal Open Market Commission (FOMC) is the Fed policy-making torso that meets viii times a twelvemonth to make budgetary policy decisions. Information technology uses its ability to change the money supply in club to control aggrandizement and interest rates, increase employment, and influence economic activity. Three tools used by the Federal Reserve System in managing the money supply are open market operations, reserve requirements, and the discount rate. (Figure) summarizes the short-term effects of these tools on the economy.

Open market operations—the tool most often used past the Federal Reserve—involve the purchase or auction of U.Due south. government bonds. The U.S. Treasury issues bonds to obtain the extra money needed to run the government (if taxes and other revenues aren't enough). In effect, Treasury bonds are long-term loans (five years or longer) fabricated by businesses and individuals to the government. The Federal Reserve buys and sells these bonds for the Treasury. When the Federal Reserve buys bonds, it puts money into the economic system. Banks have more than money to lend, and so they reduce involvement rates, which more often than not stimulates economical activity. The opposite occurs when the Federal Reserve sells government bonds.

| The Federal Reserve System'south Monetary Tools and Their Effects | ||||

|---|---|---|---|---|

| Tool | Activity | Effect on Money Supply | Upshot on Involvement Rates | Effect on Economic Activeness |

| Open market operations | Buy authorities bonds | Increases | Lowers | Stimulates |

| Sell government bonds | Decreases | Raises | Slows Downwardly | |

| Reserve requirements | Raise reserve requirements | Decreases | Raises | Slows Down |

| Lower reserve requirements | Increases | Lowers | Stimulates | |

| Discount rate | Raise discount rate | Decreases | Raises | Slows Down |

| Lower discount rate | Increases | Lowers | Stimulates | |

Banks that are members of the Federal Reserve System must hold some of their deposits in cash in their vaults or in an account at a district bank. This reserve requirement ranges from three to ten percent on different types of deposits. When the Federal Reserve raises the reserve requirement, banks must hold larger reserves and thus have less money to lend. Equally a result, interest rates rise, and economic activeness slows downwards. Lowering the reserve requirement increases loanable funds, causes banks to lower interest rates, and stimulates the economy; notwithstanding, the Federal Reserve seldom changes reserve requirements.

The Federal Reserve is chosen "the banker'south bank" because it lends money to banks that demand it. The involvement charge per unit that the Federal Reserve charges its member banks is chosen the discount rate. When the disbelieve rate is less than the toll of other sources of funds (such as certificates of deposit), commercial banks infringe from the Federal Reserve so lend the funds at a higher rate to customers. The banks profit from the spread, or difference, between the rate they charge their customers and the charge per unit paid to the Federal Reserve. Changes in the discount charge per unit usually produce changes in the interest charge per unit that banks charge their customers. The Federal Reserve raises the discount rate to slow down economic growth and lowers it to stimulate growth.

Setting Rules on Credit

Another action of the Federal Reserve System is setting rules on credit. It controls the credit terms on some loans fabricated by banks and other lending institutions. This ability, called selective credit controls, includes consumer credit rules and margin requirements. Consumer credit rules establish the minimum down payments and maximum repayment periods for consumer loans. The Federal Reserve uses credit rules to boring or stimulate consumer credit purchases. Margin requirements specify the minimum corporeality of cash an investor must put up to buy securities or investment certificates issued by corporations or governments. The remainder of the purchase cost tin exist financed through borrowing from a bank or brokerage business firm. By lowering the margin requirement, the Federal Reserve stimulates securities trading. Raising the margin requirement slows trading.

Distributing Currency: Keeping the Greenbacks Flowing

The Federal Reserve distributes the coins minted and the paper money printed by the U.South. Treasury to banks. Near newspaper money is in the form of Federal Reserve notes. Look at a dollar bill and you'll see "Federal Reserve Annotation" at the acme. The big letter seal on the left indicates which Federal Reserve Bank issued it. For example, bills bearing a D seal are issued by the Federal Reserve Bank of Cleveland, and those with an 50 seal are issued by the San Francisco commune bank.

Making Check Clearing Easier

Another important activity of the Federal Reserve is processing and clearing checks between financial institutions. When a check is cashed at a financial institution other than the one belongings the account on which the cheque is drawn, the Federal Reserve's system lets that fiscal institution—even if afar from the institution holding the account on which the check is drawn—quickly convert the check into cash. Checks drawn on banks within the same Federal Reserve district are handled through the local Federal Reserve Bank using a series of bookkeeping entries to transfer funds between the fiscal institutions. The process is more circuitous for checks processed betwixt different Federal Reserve districts.

The fourth dimension betwixt when the check is written and when the funds are deducted from the check writer'due south account provides float. Bladder benefits the check writer past assuasive it to retain the funds until the cheque clears—that is, when the funds are actually withdrawn from its accounts. Businesses open accounts at banks around the country that are known to have long check-clearing times. By "playing the float," firms tin keep their funds invested for several extra days, thus earning more money. To reduce this practice, in 1988 the Fed established maximum bank check-clearing times. However, as credit cards and other types of electronic payments have become more popular, the use of checks continues to turn down. Responding to this refuse, the Federal Reserve scaled back its check-processing facilities over the past decade. Current estimates suggest that the number of check payments has declined by two billion annually over the last couple of years and volition continue to practice then as more people apply online cyberbanking and other electronic payment systems.

"The Federal Reserve Payments Study 2016," https://www.federalreserve.gov, accessed September seven, 2017; Brad Kvederis, "The Paper Check Lives: Why the Check Decline Slowed in 2016," http://fi.palatial.com, January 19, 2017.

Managing the 2007–2009 Financial Crunch

Much has been written over the past decade about the global fiscal crisis that occurred between 2007 and 2009. Some suggest that without the Fed'south intervention, the U.S. economy would have slipped deeper into a financial low that could have lasted years. Several missteps past banks, mortgage lenders, and other fiscal institutions, which included approving consumers for home mortgages they could not afford then packaging those mortgages into loftier-risk financial products sold to investors, put the U.Southward. economy into serious financial trouble.

"BLS Spotlight on Statistics: The Recession of 2007–2009," http://www.bls.gov/spotlight, accessed September 7, 2017.

In the early 2000s, the housing industry was booming. Mortgage lenders were signing up consumers for mortgages that "on paper" they could afford. In many instances, lenders told consumers that based on their credit rating and other fiscal data, they could easily take the next step and purchase a bigger house or maybe a vacation home because of the availability of mortgage money and depression interest rates. When the U.S. housing bubble burst in belatedly 2007, the value of existent estate plummeted, and many consumers struggled to pay mortgages on houses no longer worth the value they borrowed to buy the properties, leaving their real estate investments "underwater." Millions of consumers simply walked away from their houses, letting them get into foreclosure while filing personal bankruptcy. At the aforementioned time, the overall economy was going into a recession, and millions of people lost their jobs as companies tightened their belts to try to survive the financial upheaval affecting the United states as well as other countries across the earth.

"Predatory Lending," The Economist, https://world wide web.economist.com, accessed September 7, 2017; Steve Denning, "Lest We Forget: Why Nosotros Had a Financial Crunch," Forbes, http://world wide web.forbes.com, November 22, 2011.

In addition, several leading financial investment firms, particularly those that managed and sold the high-take a chance, mortgage-backed financial products, failed quickly because they had not fix aside enough coin to embrace the billions of dollars they lost on mortgages now going into default. For example, the venerable financial company Carry Stearns, which had been a successful business organisation for more than than 85 years, was eventually sold to JP Morgan for less than $10 a share, even after the Federal Reserve made more than $50 billion dollars available to help prop up financial institutions in trouble.

Kimberly Amadeo, "What Is Too Large to Fail? With Examples of Banks," The Balance, https://www.thebalance.com, accessed September 7, 2017; John Maxfield, "A Timeline of Bear Stearns' Downfall," The Motley Fool, https://www.fool.com, accessed September vii, 2017.

Later on the plummet of Bear Stearns and other firms such as Lehman Brothers and insurance giant AIG, the Fed fix up a special loan program to stabilize the banking organization and to go on the U.S. bond markets trading at a normal pace. Information technology is estimated that the Federal Reserve made more than $9 trillion in loans to major banks and other financial firms during the two-year crisis—not to mention bailing out the automobile manufacture and buying several other firms to keep the fiscal organisation afloat.

Chris Isidore, "Fed Made $9 Trillion in Emergency Overnight Loans," CNN Money, http://coin.cnn.com, accessed September 7, 2017.

Equally a result of this fiscal meltdown, Congress passed legislation in 2010 to implement major regulations in the fiscal industry to prevent the future collapse of financial institutions, as well to put a check on abusive lending practices by banks and other firms. Amid its provisions, the Dodd-Frank Wall Street Reform and Consumer Protection Human action (known as Dodd-Frank) created an oversight council to monitor risks that bear on the financial industry; requires banks to increase their cash reserves if the council feels the bank has too much take chances in its current operations; prohibits banks from owning, investing, or sponsoring hedge funds, individual equity funds, or other proprietary trading operations for profit; and set up up a whistle-blower programme to reward people who come up forward to written report security and other financial violations.

Mark Koba, "Dodd-Frank Act: CNBC Explains," CNBC, https://world wide web.cnbc.com, accessed September 7, 2017.

Another provision of Dodd-Frank legislation requires major U.S. banks to submit to annual stress tests conducted by the Federal Reserve. These almanac checkups determine whether banks take enough majuscule to survive economical turbulence in the fiscal arrangement and whether the institutions can identify and measure out chance equally part of their capital plan to pay dividends or buy back shares. In 2017, seven years after Dodd-Frank became police force, all of the land's major banks passed the almanac examination.

James McBride, "The Role of the U.S. Federal Reserve," Council on Strange Relations, https://world wide web.cfr.org, accessed September 7, 2017; Donna Borak, "For the Kickoff Time, All U.S. Banks Pass Fed'south Stress Tests," CNN Money, http://money.cnn.com, June 28, 2017.

The Federal Reserve kept short-term interest rates close to 0 percent for more than seven years, from 2009 to December 2015, equally a effect of the global financial crisis. Now that the economic system seems to be recovering at a slow just steady footstep, the Fed began to raise the interest rate to 1.00–1.25 percent in mid-2017. What event do higher interest rates take on the U.S. economy? (Credit: ./ Pexels/ CC0 License/✓ Free for personal and commercial utilize/✓ No attribution required)

- What are the four central functions of the Federal Reserve Organisation?

- What three tools does the Federal Reserve System utilize to manage the coin supply, and how does each bear upon economic activeness?

- What was the Fed'due south office in keeping the U.Due south. financial markets solvent during the 2007–2009 financial crisis?

Summary of Learning Outcomes

- How does the Federal Reserve manage the money supply?

The Federal Reserve Organization (the Fed) is an independent authorities bureau that performs four main functions: carrying out monetary policy, setting rules on credit, distributing currency, and making check clearing easier. The iii tools it uses in managing the money supply are open market operations, reserve requirements, and the discount charge per unit. The Fed played a major office in keeping the U.Due south. financial organisation solvent during the financial crisis of 2007–2009 by making more than $nine trillion available in loans to major banks and other financial firms, in improver to bailing out the auto industry and other companies and supporting congressional passage of Dodd-Frank federal legislation.

Glossary

- discount rate

- The interest rate that the Federal Reserve charges its member banks.

- Federal Reserve System (Fed)

- The primal depository financial institution of the United states of america; consists of 12 district banks, each located in a major U.Due south. city.

- open marketplace operations

- The purchase or sale of U.S. authorities bonds by the Federal Reserve to stimulate or slow down the economy.

- reserve requirement

- Requires banks that are members of the Federal Reserve System to hold some of their deposits in cash in their vaults or in an account at a commune bank.

- selective credit controls

- The ability of the Federal Reserve to control consumer credit rules and margin requirements.

Source: https://opentextbc.ca/businessopenstax/chapter/the-federal-reserve-system/

Posted by: woodsterestand.blogspot.com

0 Response to "What Are Some Ways In Which The Fed Attempts To Control The Money Supply"

Post a Comment