What Can I Buy With $1 Dollar To Make Money

Wait to need at least $100K of income for a $1M home

There'south no magic formula that says y'all need X income to afford a $1 1000000 firm. Because income is but role of the equation.

With a actually strong financial profile — high credit, depression debts, big savings — you might afford a $1 million dwelling with an income around $100K.

Only if your finances aren't quite every bit strong, you might need an income upwards of $225K per yr to buy that million-dollar domicile.

Wondering how much house you tin afford? Here's how you lot tin can find out.

In this commodity (Skip to...)

- Income to afford a million dollar home

- Income examples

- Summate your home ownership upkeep

- Don't forget nearly homeownership costs

- Benefits of buying a $1M house

- Today's mortgage rates

Household income to afford a million-dollar dwelling

There's no "magic" income number to beget a million dollar business firm.

In reality, it's possible to buy a $1million home with a variety of income levels. That's because your domicile-buying upkeep depends on other factors, too, like your downwards payment, debt-to-income ratio, and mortgage rate.

Take a await at the table beneath for a quick overview of how these factors, combined with your salary, can touch on your 1000000 dollar domicile buy:

| Annual salary | Down Payment | Monthly debt | Interest Rate* | Monthly payment |

| $147,000 | 20% | ≤ $250 | 2.75% | $iv,100 |

| $224,000 | xx% | ≤ $2,500 | 2.75% | $4,220 |

| $224,000 | 20% | ≤ $2,500 | 3.00% | $4,252 |

| $110,000 | 50% | ≤ $250 | 2.75% | $2,900 |

*Estimates based on xxx-year fixed-rate loan, property tax charge per unit at 0.97% annually, home insurance premium of $600 per year, and no HOA dues. Interest rates are for examples purposes only. Your own interest charge per unit will be different.

A million dollars was one time a lot of coin to pay for a home, and unless yous lived in Los Angeles or San Francisco, you probably would never consider purchasing 1.

Only equally home values continue to skyrocket across the country, million-dollar homes are becoming more than common outside of California and New York. The proficient news is that you don't need to be a millionaire to afford one. Only y'all should have your personal finances in order to ensure y'all get the best rate.

Examples: How much y'all have to brand to afford a one thousand thousand-dollar dwelling house

Monthly income is only one cistron in your home buying budget. The purchase cost you can afford also depends on your:

- Debt-to-income ratio (DTI)

- Credit score

- Downwardly payment amount

- Mortgage rate

We experimented with a few of these factors using our dwelling affordability calculator to show you how much each one can impact your budget.

Prime borrower: $147,000 income needed

Our first example looks at a traditional 'prime' borrower (one with excellent credit and strong finances). They have:

- A 20% down payment ($200,000)

- Only $250 in pre-existing monthly debts

- An excellent mortgage charge per unit of 2.75%

This borrower tin beget a $1 1000000 dollar house with an annual salary of $147,000. Their monthly mortgage payment would be about $four,100.

Loan summary:

- Buy price: $ane meg

- Down payment: $500,000

- Loan amount: $500,000

- Loan term: 30 years

Monthly mortgage payment breakdown:

- Principle and interest: $three,266

- Monthly revenue enhancement: $808

- Monthly insurance: $fifty

- Total: $iv,124

High-DTI borrower: $224,000 income needed

Let's leave everything else the same as in the first instance, but increment the borrower's monthly debt payments to $2,500.

For those paying multiple child back up and alimony payments, that might be more than realistic, fifty-fifty if their debts are only average.

And others have that level of debt payment even without family commitments. Call up luxury car, boat, motorhome, and other big-ticket toys.

In this scenario, the income needed to beget a domicile costing $one.031 million would be $224,000.

To beget a million-dollar dream domicile, you'd demand a slightly higher down payment of $214,000. And monthly payments would cost almost $4,220.

Clearly, existing total debt makes a big departure in abode affordability. Your bacon needs to be $77,000 higher to buy a home at the same toll point.

Lower credit borrower: $224,000 income needed

As a rule of thumb, a million-dollar buy toll volition require a jumbo loan.

To get a colossal loan, you typically demand a credit score of 700 or college. Only permit'southward say a borrower has a credit score on the lower end of the approvable range.

A lower credit score ways they'll have to pay a higher interest rate than our earlier examples. Nosotros'll say 3.0% instead of the two.75% used earlier.

Loan summary

- Purchase price: $1,005,000*

- Downward payment: $201,000

- Loan amount: $804,000

- Loan term: 30 years

Monthly payment breakdown

- Principle and involvement: $iii,390

- Monthly tax: $812

- Monthly insurance: $50

- Total: $four,252

That same $224,000 household income will still buy a $1 meg home, though the upkeep comes in at one at $1,005,000 rather than $1,031,000 — a full $25,000 lower. And that'southward still assuming $ii,500 in monthly debt payments.

Let'southward say you can beget a 50% downwards payment. Perhaps y'all've built upwards lots of equity as a long-continuing homeowner. Or maybe you've had a windfall.

Chances are, in your happy financial position, you've paid downwards nearly of your total debt, so we'll return that number to $250 in monthly debt repayment.

Loan summary

- Purchase price: $one meg

- Downward payment: $500,000

- Loan corporeality: $500,000

- Loan term: thirty years

Monthly payment breakup

- Principle and involvement: $2,041

- Monthly tax: $808

- Monthly insurance: $50

- Total: $2,900

By putting down half the purchase price ($500,000) you tin can beget a $1 1000000 abode on an income of just $110,000.

Even putting downward 30% makes a big difference compared to 20%.

With 30% down, you could potentially afford a $1,037,000 home on an income of $140,000. Compare that with needing an income nigh $150,000 if yous put down only twenty%.

How to calculate your home buying budget

The best style to figure out your home buying budget — short of contacting a lender — is to use a mortgage calculator.

This mortgage estimator will help you lot figure out how much firm you can afford based on your salary, down payment, and debts. It also accounts for other factors, like your mortgage involvement charge per unit and estimated property taxes and homeowners insurance costs.

To get the best estimate, be as accurate as you can when filling out each field.

- Almanac income: Your gross income from all sources earlier tax

- Country: Your location can affect the deal you'll get. And it will too touch your property taxes

- Monthly debts: Minimum credit carte du jour payments, loan installments, car loans, student loans, plus pension and child support. In other words, all your inescapable, monthly fiscal obligations. But non things that vary, such as food, gas, utilities, and so on

- Loan term: Are you using a xxx-year fixed-rate mortgage loan or a 15-year fixed-charge per unit loan? This will have a big bear upon on how much house y'all tin afford

- Interest rate: You won't know your mortgage rate for certain until you get loan estimates from multiple lenders. The default shown on our estimator is an boilerplate rate on the twenty-four hours you visit; yours volition be higher or lower, depending mainly on your credit, downward payment, and debt burden. So accommodate equally best you can

- Down payment: Your down payment affects your involvement rate every bit well every bit your overall home-buying budget. Assume yous'll demand at least 20% of the purchase toll to go approved for such a big loan

- Other homeownership costs: Estimate your future homeowners insurance premiums and property taxes. The numbers in the calculator are state averages. And add in monthly homeowners association ante, if you're buying in an HOA's area, or private mortgage insurance payments (PMI), if yous're putting less than 20% downward on a conventional loan

Remember, a calculator can only give you an estimate. To know whether you can really afford a 1-2 one thousand thousand dollar home, y'all'll need to become preapproved by a mortgage lender.

Preapproval means the lender has verified your credit, income, savings, and other items on your application.

If you have a preapproval alphabetic character in hand stating yous can afford a million-dollar habitation, then information technology's more or less a sure affair. (Unless whatsoever of your financials or mortgage rates change essentially prior to purchase.)

Don't forget about homeownership costs

So far, we've simply looked at the purchase price for a million-dollar firm.

We've explored the principal (repaying the sum you borrowed) and interest on your mortgage. And we've taken into account your probable property taxes and homeowners insurance.

But there are plenty of other costs associated with owning a dwelling house — especially with high-value real estate. And you'll demand to budget for these equally well.

- Endmost costs: 2%-5% of loan amount

- Property taxes: about 1% of home value

- Homeowners insurance: $100-$200 per calendar month

- Utilities: average of $one-$2 per square foot

- Maintenance: variable cost

Closing costs

People often think about their home ownership budget in terms of down payment. For a $one 1000000 home, y'all're likely to need a minimum of $100,000 to $200,000 saved for that purpose.

But a downward payment isn't the only thing to salvage for. Habitation buyers have to consider closing costs on their domicile purchase, too.

Closing fees typically starting time effectually 2% of the buyer's loan amount.

And so if you lot're borrowing $800,000 to buy a meg-dollar business firm, your closing costs could be around $sixteen,000 or more. You'll need to factor this number in when thinking about how far your savings will stretch.

Property taxes

Dwelling house buyers also need to consider their future belongings taxes.

Existent estate tax rates are fix by local revenue enhancement regime, and they vary a lot depending on where you live. But to give you a ballpark estimate, the boilerplate national property tax rate is around i% according to the Revenue enhancement Foundation.

That means on a $one meg house, at that place's a proficient take chances you could pay around $ten,000 per year in holding taxes. That'due south over $800 per month.

Research property revenue enhancement rates where yous program to buy and make sure yous gene this cost into your budget for ongoing housing costs.

Homeowners insurance

Homeowners insurance is probable to be more expensive on a larger home, besides. The typical homeowner might spend $50 to $75 per calendar month to insure a standard home.

But a larger abode costs more than to supercede if information technology is destroyed by fire or another disaster. Naturally, the insurance visitor will accuse more for greater hazard.

Look to pay $100 to $200 per month to insure your 1000000-dollar home.

All in, you could pay $1,000 per calendar month in taxes and insurance, a sizeable nib to a higher place and beyond the principal and interest payment.

Running costs, repairs, renovations and maintenance

The bigger your home, the more it costs to run. The larger foursquare footage and perhaps higher ceilings that yous loved, mean you take a larger volume to heat and cool. And so your utility and HVAC servicing bills are going to be a lot college.

While utility costs vary by location, as a rule of thumb, you tin can estimate on paying between $1-2 per square foot.

A bigger dwelling also means more to clean and maintain — and often comes with a yard that will require budget.

In short, keeping a large, expensive home well maintained isn't cheap. And neither are renovations and repairs. And so plan ahead and make certain your home ownership budget leaves you lot with a sizeable cushion in your savings business relationship.

Benefits of buying a $1M house

Your ongoing costs may be higher with a bigger home. But the benefits to your net worth should typically be greater, too.

Indeed, home toll appreciation averaged 15% throughout 2021 according to CoreLogic.

That means if your dwelling house was worth $500,000 in 2020, it was probable worth $575,000 or more at the stop of 2021 — netting you lot a $75,000 home equity gain.

And for a million-dollar habitation? Prices were up past nigh $150,000 year-over-twelvemonth on average. So you're likely to run into a dainty return on the money you invest in your firm.

Of course, all this relies on home prices continuing to ascension. And we all know that they very occasionally fall.

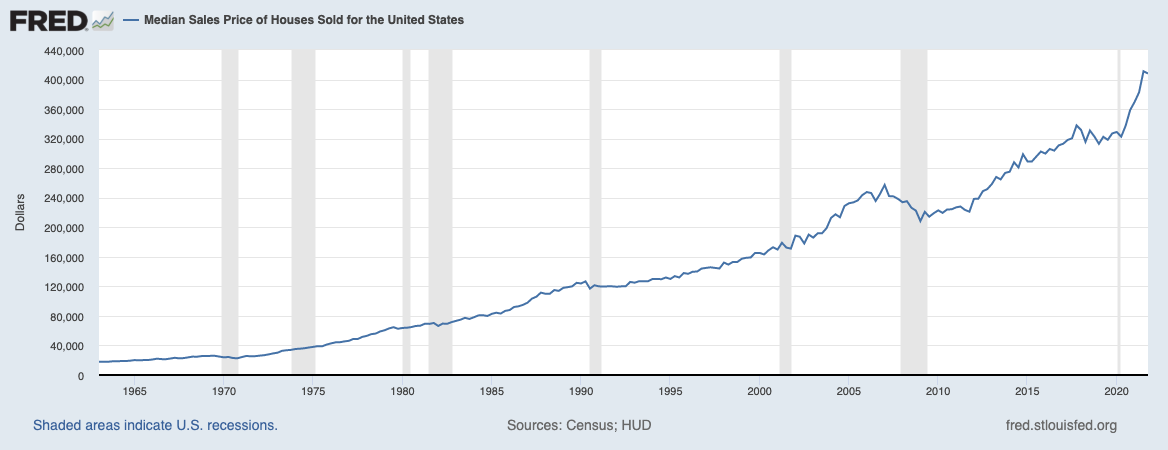

But take a wait at this graph from the Federal Reserve Banking concern of St. Louis:

Source: U.S. Census Bureau and U.Southward. Section of Housing and Urban Development data via St. Louis Fed

You tin see how rare it is for dwelling values to decrease — and how strong the overall upwardly trend is.

You might recollect real estate is not a bad place to have $1 million invested.

What are today's mortgage rates?

There's one other trend prospective home buyers should pay attending to, and that's mortgage rates.

Low mortgage rates boost affordability. But when rates rise, it tin can be harder to afford a home at the high cease of your budget.

Then it's worth looking into financing sooner rather than subsequently if y'all're serious virtually ownership a $ane 1000000 dwelling. And do all you lot tin can to shore up your credit score and savings before applying.

The information independent on The Mortgage Reports website is for advisory purposes just and is not an ad for products offered past Full Beaker. The views and opinions expressed herein are those of the author and practice non reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Source: https://themortgagereports.com/71443/income-to-afford-1-million-dollar-house

Posted by: woodsterestand.blogspot.com

0 Response to "What Can I Buy With $1 Dollar To Make Money"

Post a Comment